Lucienne is a 34-year-old woman who lives with her husband and their four children in a house in Nan Lagon, a neighborhood just a short walk from the center of Gwo Moulen. She joined the CLM program in April.

The couple had once been more prosperous than they are now. They are farmers, and they would use the sales of the crops, especially their beans, to manage their more important expenses. It was, for example, enough for them to build a nice home, which they covered with roofing tin.

But the yields have been decreasing steadily. “The last time we had a really good harvest was when my youngest, my six-year-old, was still nursing. Harvesting was so much work, we had to hire people because I couldn’t help.” Since then, they’ve had very little to show for their farming. “This year, we planted three cans of beans, and didn’t harvest enough to make a meal.”

Lucienne has kept her family going for years with small commerce, even without means of her own. She has depended a sòl, a kind of savings club common in Haiti. Members make regular contributions, and every time there is a scheduled contribution, one member takes the entire pot. In Lucienne’s sòl, the contribution is currently 500 gourds — a little less than four dollars — and they make contributions on Wednesdays and Saturdays, the days of the large market in downtown Laskawobas.

Lucienne has been able to use the group because they have always been willing for her to take the pot first. That way, it works as an interest-free loan. She just has to show them that they can always count on her to pay it back. That is to say, she cannot miss paying when it is the other members’ turn to collect.

But her ability to keep that commitment has enabled her to keep her commerce going. She buys produce in the neighborhood, bringing it down to Laskawobas for sale on market day. While down in Laskawobas, she buys products that are available down there and carries them back up to Gwo Moulen for sale. She does not have a pack animal, so she carries her merchandise both down and up the mountain on her head. “When I get home, I am so tired, I can’t even walk into my house. I just sit on the rock in the front yard.”

She used the investment funds that CLM provided to buy livestock. She didn’t have any. She was able to buy two goats and a small collection of poultry. There was enough left over to buy a piglet, though she had to take one that has not yet been weaned. It made it cheaper, but it means that it will take more time for it to start producing for her.

She likes having livestock because she says it gives her a way to take care of a problem if one comes up. “If one of my kids or my husband needs money for something, I can sell an animal.”

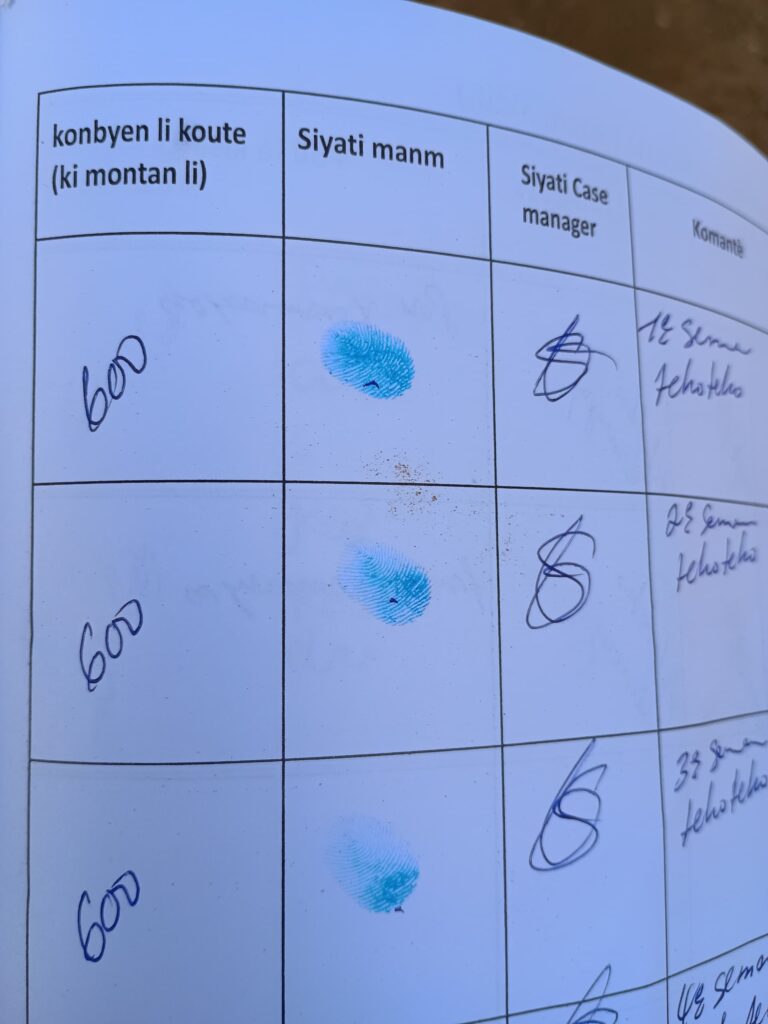

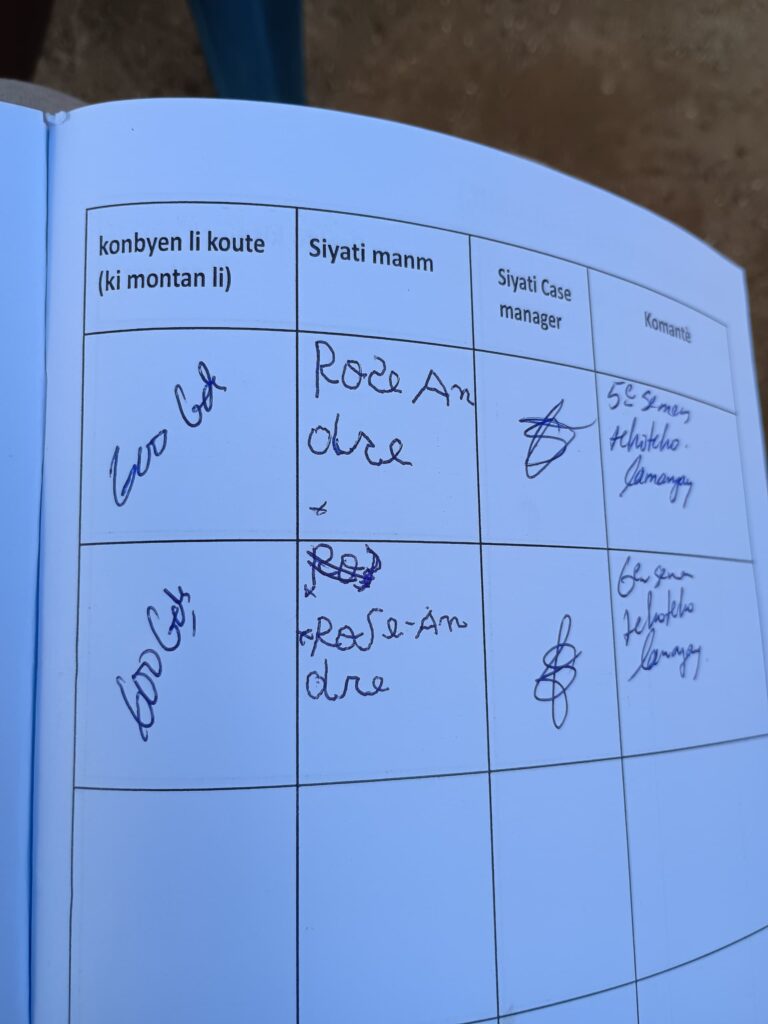

She likes being part of her CLM savings and loan association, too. Each week, she can buy up to five 100-gourd shares. At the end of its 52-week cycle, members can have saved as much as 26,000 gourds, or about $200. Lucienne hopes to have saved nearly that much. Because the association’s members take out loans that they repay with interest, she should receive more than what she has saved.

She has an idea what she’s like to do with the money. A decent horse now sells for about 50,000 gourds. If the livestock she has now produces well, she might be able sell some animals to add enough money to her end-of-cycle pay out to afford one. If not, she can buy other animals with the money from her pay out and work to increase their value until she can buy a horse. Not only would a horse make the trips up and down the mountain easier, but it would greatly increase the size of the load she could make those trips with, allowing her to transform her business into something larger than it can be now.

With the youngest of her four children already six, she was surprised when she discovered that she is pregnant. Another woman might say that her pregnancy and her time nursing a new baby will interfere will her activities, but Lucienne does not think so. “I can find people to take my merchandise up and down the hill on market day.”

Clenie’s home is just across central Gwo Moulen from Lucienne’s. She and her husband live with their youngest son and a granddaughter. Her husband, Lucien, farms, both their own land and sometimes for their neighbors, and Clenie manages a small commerce.

A small commerce in Gwo Moulen usual means hiking down to the market in Laskawobas and up again. Clenie buys beans or corn. Sometimes charcoal for cooking. She can take loads down the hill thanks to a mule that she bought with a loan that she got from the local credit union. There is a small one in Gwo Moulen. The loan was for 60,000 gourds — about $460 — and the mule cost almost 70,000 gourds. She was supposed to pay the loan back in just six months. Although itt took her a little longer than that, she finally repaid it all.

But having the mule made a big difference. Clenie explains that, in Gwo Moulen, “if you don’t have a pack animal, you have to work to buy one.” It is hard to build a livelihood without one because the main markets are not close by. But in the dry season, things are even worse. Fetching all the water that a family needs can become an all-day proposition without an animal that can carry multiple jugs each trip to the spring.

Without assets other than her mule and with little investment in her small commerce, Clenie qualified for the CLM team’s EP program, a new approach for families wealthier than those who qualify for its traditional program but who might be at risk of falling into ultra poverty. She received funds to invest in her business, some coaching, and membership in a VSLA.

Clenie received 25,000 gourds to invest in income generation, and she wanted to use most of it to buy livestock. She initially planned to buy goats and turkeys, but to to save 5,000 gourds of the money to invest in commerce. When she thought about what 5,000 would be able to add to her business, however, she decided it made more sense to add to her animals, and she purchased a small hog. She will fatten it up until she can sell it.

She is excited to now have a range of different animals. Different animals can serve to help with different kinds of expenses. “Each has a role. You can have a problem that makes you lay hold of one of your turkeys. Another kind of problem just needs a chicken.” She hopes that she will be able to increase the value of her animals, especially the goats and the pig, until she can sell some of them to buy a cow. For her, owning a cow is a first step towards buying land, and she would like to have a plot somewhere down the mountain.

She also used the program to fulfill another wish. She had long wanted to have a latrine. “I don’t know if it was just laziness, but we never got around to it.” When she saw the latrines that the program was helping poorer members install, she decided the time had come. She found out what materials she needed, and she and Lucien acquired them. Then he dug the pit. They called the mason who the program had brought to the area over to her house. When he told her that she’d have to pay him herself, she answered that she understood that. And now she has her own latrine.

We wrote about Rosemitha a few months ago, shortly after she had first joined the program. She’s a single mother. She and her baby both live with her mother, who is also a member of the program. Her baby wasn’t planned. She reports that she was raped as a ninth grader. But she now seems to be organizing her life around how she can take care of her boy.

She received money to install a latrine in the yard she shares with her mother. It is the very first thing that she mentions when she’s asked how her life has changed since she joined the program.

The second change she cites has little to do with CLM. By the standards of Gwo Moulen, she’s pretty well-educated, so the local school director hired her to teach first grade. She asked her case manager whether it was okay for her to take the job, but the CLM could not have been happier.

She likes the work. She spends her afternoons studying the Haitian government’s program for first grade, and the school’s principal is generous with advice. He held a first teacher training for the staff at the beginning of the year, and Rosemitha says he plans more through the year. The post pays just 5,000 gourds per month. That’s less than $40. And Rosemitha knows that it is not a lot. “But it is better than sitting around and not doing anything.”

She received 23,000 gourds to invest in economic activities, and she used all of it to buy livestock. She bought two goats, a pig, a turkey, and a chicken. The pig died shortly after she bought it, but she’s confident she’ll be able to replace it by the end of December, and she’s determined to do so. Like Clenie, she likes having different sorts of animals. Both for the reason that Clenie cites — the need to have assets with different values that you can sell to address different size needs — and because having different kinds of animals reduces risk. If one sort has problems, the other might be unaffected.

She likes participating in her savings and loan association. “It’s teaching me to save. If you try to put money away at home, you can decide to spend it.” She is not able to buy five shares — the most the rules allow — every week, but she buys some every week. She doesn’t yet know what she will do with the money she’s saved, but she suspects she’ll want to buy more livestock.

She just took out her first loan from the association. It was for 3,000 gourds, and she’s using the money to start a very small commerce. She has bought kasav, a Haitian flatbread made of manioc, and peanuts to make peanut butter. She plans to sell kasav bere, flatbread spread with peanut butter, an inexpensive and popular snack.

She has a clear plan for the next few years. As soon as her boy his weaned, she wants to return to school. She’ll go down to Laskawobas on Mondays, and come home on Fridays. Her baby will stay with her mom, who seems pleased at the prospect of Rosemirtha getting her education back on track.