Bettie Faustin returned to Kaledan, a community on the road through Savanèt, after the Pòtoprens earthquake in 2010. She had been a successful merchant in the capital, selling mainly clothing. But the earthquake destroyed what she had — “All my money disappeared under the rubble” — so she returned home.

She was able to start a small commerce immediately upon her return. She and some neighbors organized a sòl, or a savings club. Each week, they all contribute to a pot, and someone took the whole pot. The other women saw Bettie had nothing, so the let her have the first pay-out, and she used the money to buy bread, kasav, which is a Haitian flat bread, and peanuts. She made peanut butter, and sold peanut butter sandwiches along the road in Kaledan.

She and her partner worked hard. They knew that they could make more money from a bean harvest than from her very small commerce, so they would take money out of the business when planting season came around and invest it in a field of beans.

But their field was high up on the slope. That’s typical for poorer families. So, it was entirely dependent on rainfall. One year, they got no rain when they needed it. They lost the whole field. And, so, Betty lost her commerce as well.

The couple struggled, but through it all, they made one commitment to their children. They made sure they always sent them to school. Bettie remember how her mother made the then-unusual sacrifices to send her to school. “Even if you have nothing to eat, you always have to send them. That’s the inheritance you can give them.” When things were really difficult, she sent her oldest, who is now in his early 20s, to live with her sister in Pòtoprens. From there, he fled to the Dominican Republic, in search of work. Her four younger kids live with her and her partner and all are in school.

Bettie asked the program to give her goats and small commerce, and she receive two small goats. One had a kid, and she bought a fourth goat with income from the business she established. She has a plan for her goats: She wants to sell some of them when she has enough so that she can buy a cow.

She started a commerce buying and selling poultry. And it was working. It enabled her to manage her household and also to buy the additional goat. But poultry disease swept through the area in February, and it killed twelve of her chickens, eliminating her commerce. Ever since, her family has been living off the remaining proceeds of her last bean harvest and her partner’s income. He makes money cutting down trees and turning them into planks for carpenters.

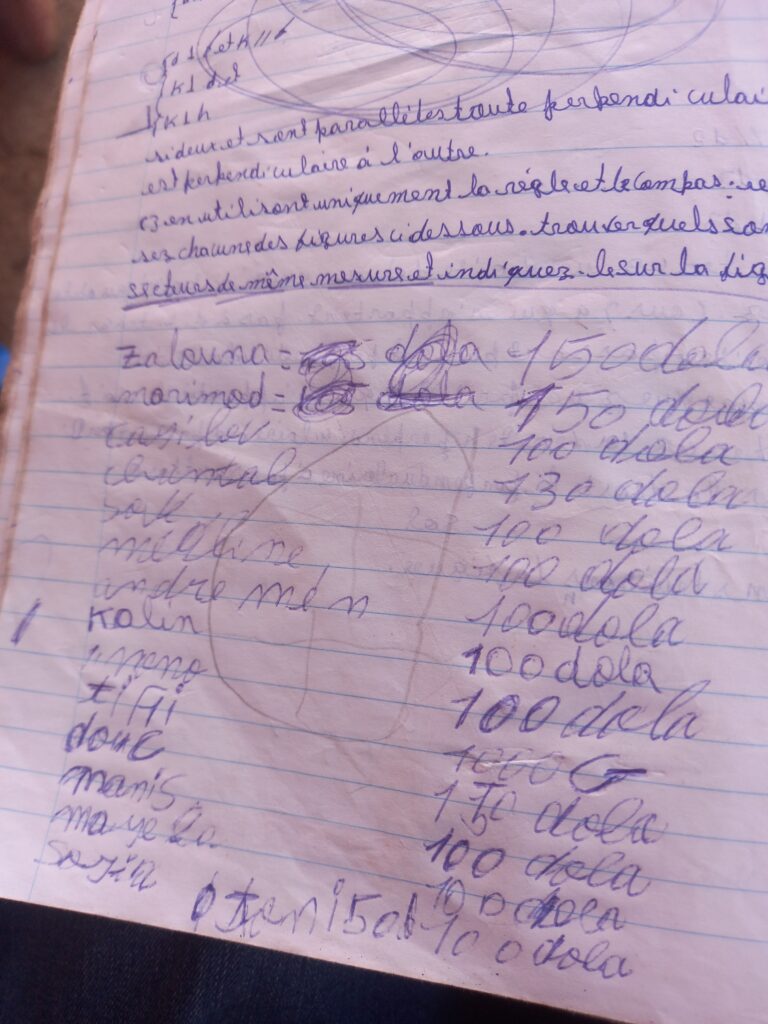

That money was enough for them to get by and for her to continue regular contributions to her savings group. Just this week, the year-long cycle ended, and Bettie received her pay-out. It was about 12,000 gourds.

She has a plan for this money, and it is an unusual one. She and her partner have decided to get married. Normally we would encourage a member to use her savings, or at least some of her savings, to generate income. Especially in a case like Bettie’s, who recently lost her small commerce.

But Bettie is determined to get married, which will involve some expense, and it is really up to her.

And she has another plan to get her business started again. A short time ago she lent a friend 6,000 gourds that she took from her business. The friend is ready to pay her back, but she has asked them to hold on to the money for the time being. She knows that if she takes it now, it will go into the wedding too, but if she takes it after the marriage, she’ll be able to use it to start buying poultry again.

Dieusanie St. Phil is a single mother of four, living just across the road from Bettie, on a small plot of land she bought in better times. “It wasn’t expensive back when I bought it.” She lives with her four children. She was only able to send two of the four to school this year. She just didn’t have the means to send the others. “They will all go to school in September,” she says.

For years she has supported them by selling day labor, mainly helping neighbors with their bean crops. “Sometimes they pay money, sometimes they send me home with some beans or some corn.” But she says she has stopped that sort of work since she joined CLM.

She asked the team for goats, and she received two. Each had a kid, but only one of the kids survived. She herself bought an additional goats with money she saved from her weekly stipend. The goats are important to her. “I will take care of them so I can use them to send my children to school.”

Her real progress has come through her small commerce. She borrowed 6,000 gourds from her savings and loan association, and began selling local rum and cigarettes. She used the profit to increase her investment, adding other products, like home-made snuff and coffee that she roasts and grinds.

Products like snuff and coffee — things that she produces — tend to have a higher margin than things one simply buys and sells, and they have become, together with the rum, the focus of Dieusanie’s business.

When she finished repaying her first loan, she took a second for 20,000, and threw all the money into her wall commerce. She had no trouble repaying that second loan. Most encouraging is that she has been able to maintain her business even while repaying the loan. Her repayments have come, in other words, mainly from profits.

She saved in the same savings and loan association that Bettie was a part of, and she too amassed about 12,000 gourds. She doesn’t feel that her commerce needs the additional capital right now, so she has decided to buy a pig as a new investment.

She is happy with the progress she’s made, but she knows she has father to go, and she expresses this clearly. “I wouldn’t say that I am well-off, but I have started my way along a path.”